The third-party debt collection industry employs thousands of Americans and influences the employment of thousands more. By recovering tens of billions of dollars in delinquent consumer debt that would otherwise go uncollected, the industry generates important benefits to the US economy.

To develop a more complete picture of the economic importance of the third-party debt collection industry, ACA International (“ACA”) commissioned Ernst & Young to conduct a survey of third party debt collection agencies. Survey data collection took place between September and November of 2011 to ACA members and non-member contacts which the ACA provided.

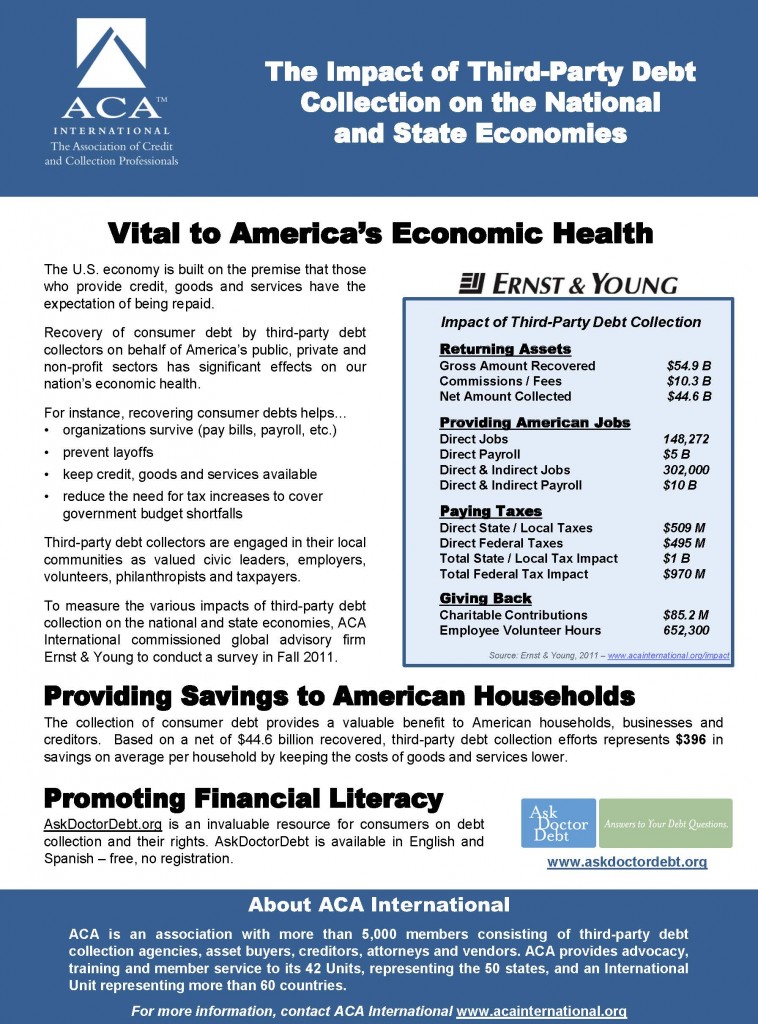

The resulting study, The Impact of Third-Party Debt Collection on the National and State Economies, gives estimates of key metrics that provide an overview of the third-party debt collection industry in the United States for 2010. Key measures of industry size and impact include the following:

- Agencies recovered approximately $54.9 billion in total debt in 2010, on which they earned $10.3 billion in commissions. Removing commissions from the total debt recovered leaves over $44.6 billion in debt that agencies returned on a commission basis to creditors and the U.S. economy .The five states with the highest total debt collected are Texas ($5.3 billion), New York ($5.3 billion), California ($4.4 billion),Florida ($2.8 billion) and Illinois ($2.7 billion).

- Early out debt, consisting of receivables that aged 90 days or less, represents 30% of all debt collected; bad debt, which accounts for the remaining 70%, consists of receivables aged 90 days or more.

For entire report: http://www.acainternational.org/files.aspx?p=/images/21594/2011acaeconomicimpactreport.pdf

http://www.acainternational.org/files.aspx?p=/images/21594/2012acaeyhandout.pdf